July 8, 2019 – Brixton Metals Corporation (TSXV: BBB) (OTCQB: BBBXF) (the “Company” or “Brixton”) is pleased to announce that it has kicked off the drilling program and to provide results from the soil and rock samples collected in May-2019 at its Atlin Goldfields Project located in Northwest British Columbia. The 2019 drill program will consist of many shallow NQ size core drill holes on numerous targets to test for new, near surface high-grade gold mineralization.

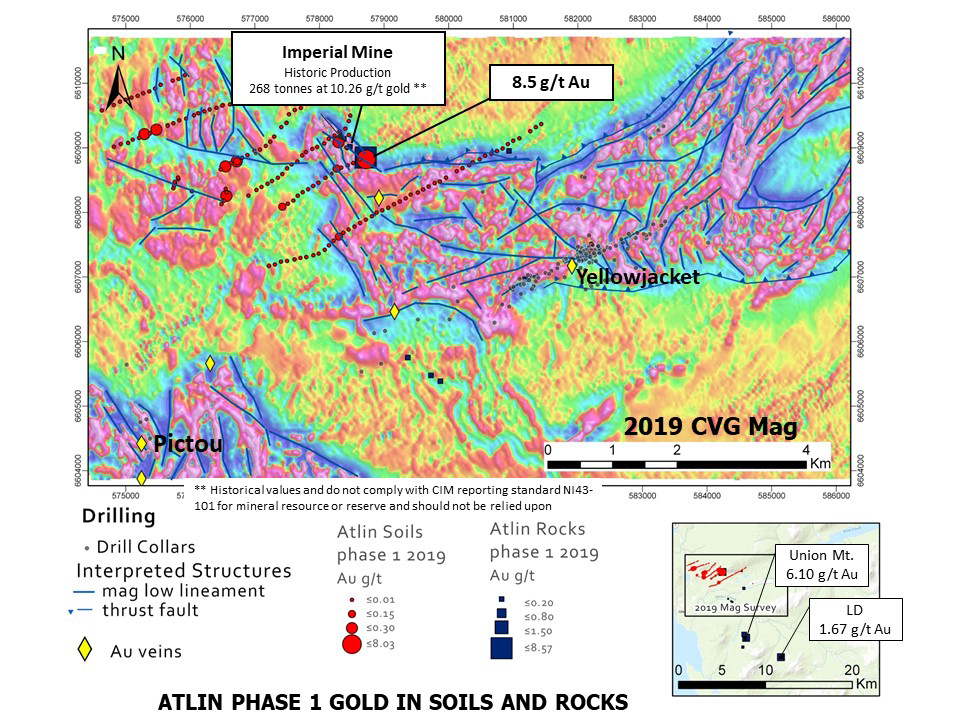

Chairman and CEO of Brixton Metals, Gary R. Thompson stated, “We are excited to start our first ever drilling campaign at the Atlin Goldfields Project. We are encouraged by the gold-in-soil and magnetic geophysical features around the Imperial Mine (see Figure 2). Our work in Atlin this year has focused on the western portion of the property with good road access. It is to be determined whether this area may be a new vein corridor system reaching from the Imperial mine to Wilson creek in a northwest-southeast trend for approximately 20 km inclusive of the Yellowjacket, Union and McKee areas [see figure 1]. The project is highly prospective for both high-grade orogenic gold and intrusion related gold deposits.”

Highlights of May 2019 Soil and Rock Sampling

A total of 167 soil samples and 29 rock samples were collected at the Atlin Goldfields Project during May 2019. The samples were collected at the Imperial, Union Mountain and LD zones. Results from the soils collected this season returned one sample of 8.03 ppm Au, seven samples greater than 0.1 ppm Au and 159 samples less than 0.1 ppm Au. The elevated gold-in-soil values appears to coincide with some of the interpreted geophysical features. Results from the rock grab samples collected include 8.57 g/t Au from the Imperial mine area, 6.1 g/t Au from the Union Mountain area and 1.6 g/t Au from the LD area. Four rock grab samples returned values greater than 0.1 ppm Au with the remainder of the samples returning values less than 0.1 ppm Au.

The Company is planning to collect additional soil and rock samples during the 2019 exploration program to further refine and generate new targets with the priority area being the western portion of the property as highlighted in purple on Figure 1 below. The secondary area of interest this season is to follow up on the gold-in-soil and elevated tin-tungsten-bismuth-in-soil geochemical anomaly located on the eastern and north-eastern area of the property that appears to have an intrusion-related gold signature.

Figure 1: Surface Gold Geochem Map of Atlin Goldfields Project.

Figure 2: Surface Gold Geochem and Calculated Vertical Gradient Magnetic Map of Atlin Goldfields Project.

About the Atlin Goldfields Project

Since 2016, Brixton has staked claims and completed 12 transactions to hold approximately 933 square kilometres of mineral rights in the Atlin Mining District within the Taku River Tlingit First Nations traditional territory of Northwest British Columbia. The project is located east of the town of Atlin and is road accessible and is amenable to year-round drilling. Placer gold mining operations have been active in the Atlin Goldfields for the past 120 years; however, only limited hard rock exploration has been conducted for the source of the gold.

LD Zone

The LD Showing is approximately 12 km from Atlin and is road accessible. Previous exploration work has discovered gold mineralization associated with quartz veins hosted within a shear zone. Grab samples collected by Brixton geologists have assayed up to 293 g/t Au. During 2018, the Company completed geologic mapping, rock sampling, biogeochemical studies, and soil sampling which expanded the gold-in-soil anomaly to 1200 metres by 2000 metres. The gold-in-soil anomaly remains open to expansion.

Pictou Zone

The Pictou Showing is located 2 km from Atlin and is road accessible. Historic records going back to 1899 discovered gold-bearing quartz veins through 29 metres of underground workings. Homestake Minerals conducted exploration from 1987 to1988 and reported grab samples ranging from 15 to 60 g/t Au. The best channel sample across the showing assayed 14.3 g/t over 2 metres. Chip sampling by Brixton during 2018 of outcrop in the vicinity of the adit returned 11.75 g/t Au and 4.48 g/t Au.

Yellowjacket Mine

The Yellowjacket Mine is a permitted 200 tpd mine and mill currently on care and maintenance. The zone is an example of bedrock hosted gold mineralization. Drilling at Yellowjacket has been shallow with an average drill length of 84m. The mine is road accessible and located 9 km from the town of Atlin. Core drilling by Homestake Minerals from 1986 to 1988 and the Yellowjacket JV between 2003 and 2011 identified high-grade gold mineralization in multiple zones within an 80 metre wide shear zone. Historical drilling results include significant gold intersections:

- Hole YJ03-01: 5.57m of 509.96 g/t Au (16 opt gold)

- Hole TW05-02: 2.62m of 853.28 g/t Au (27 opt gold)

- Hole TW02-02: 13.50m of 11.21 g/t Au (0.36 opt gold)

- Hole MET06-03: 6.00m of 21.07 g/t Au (0.68 opt gold)

Imperial Mine

The Imperial Mine is approximately 3 km northwest of the Yellowjacket Mine and has a mining history going back to 1899 immediately following the discovery of placer gold in the Atlin Goldfields. Historic records indicate 268 metric tonnes were mined at a grade of 11.5 g/t Au from a 150 metre-long gold-bearing quartz vein, Minfile 104N 008.

The Qualified Person (“QP”) for Brixton cannot verify the historic drill and surface geochemical results reported above or the other technical information set out in this news release. The precise location of the drill cores from the program is presently unknown and they have not been inspected by the QP, and therefore Brixton has not undertaken sufficient re-logging, resampling or check assays; however, Brixton has no reason to doubt the results and considers the results relevant and suitable for disclosure. The QP also advises that true width of the above results cannot be determined at this time. The results disclosed above are selected intercepts or other highlights from historical work at the Atlin Properties and none of this information is supported by a technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects and the Company cautions readers that there is no certainty that these results are indicative of future exploration at the Atlin Properties and there is no certainty of similar grades from future drilling.

Update on the Thorn Project

The Company successfully completed the drilling of the deep hole at the Oban Zone to a final depth of 829 metres with HQ sized core. The assay results will be released once they become available. In addition to the drilling, the re-logging of core from previously drilled holes in the Camp Creek area and further geological mapping along with in-fill soil-rock sampling was conducted over the Chivas area.

Update on the Langis Project

The analysis of the drill core from the Langis kimberlite target has returned results of no economic interest. The Langis Project remains an attractive target for high-grade silver and cobalt mineralization and the Company plans to follow up on some of the recent high-grade drill intercepts when the silver and cobalt market improves.

Mr. Sorin Posescu, P.Geo, is a Qualified Person as defined under National Instrument 43-101 standards and has reviewed and approved this news release.

About Brixton Metals Corporation

Brixton is a Canadian exploration and development company focused on the advancement of its gold and silver projects toward feasibility. Brixton wholly owns four exploration projects, the Thorn copper-gold-silver and the Atlin Goldfields Projects located in NWBC, the Langis-Hudson Bay silver-cobalt project in Ontario and the Hog Heaven silver-gold-copper project in NW Montana, USA. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB. For more information about Brixton please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

Tel: 604-630-9707 or email: info@brixtonmetals.com

For Investor Relations please contact Mitchell Smith

Tel: 604-630-9707 or email: mitchell.smith@brixtonmetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds, By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.