VANCOUVER, BC, January 05, 2012 – Brixton Metals Corporation (TSX-V: BBB) (the “Company” or “Brixton”) is pleased to announce assay results from the balance of the 2011 drilling program at its Thorn gold-silver-copper project located in northwestern British Columbia, Canada. A total of 21 holes for 5,682m were drilled during 2011 and all analytical results have now been received.

Highlights:

Oban Breccia Zone hole THN11-60 intersected from surface 95.08m of 904 g/t AgEq (1.71 g/t Au, 628.30 g/t Ag, 0.12% Cu, 3.31% Pb and 2.39% Zn).

Including 25.56m of 1,679 g/t AgEq (2.28 g/t Au, 1,300 g/t Ag, 0.22% Cu, 5.34% Pb and 2.51% Zn) and 9.25m of 3,646 g/t AgEq (3.04 g/t Au, 2,984 g/t Ag, 0.53% Cu, 11.65% Pb and 3.42% Zn).

Oban Breccia Zone hole THN11-57 intersected 37.72m of 252 g/t AgEq (2.08 g/t Au, 60.8 g/t Ag, 0.46% Cu, 0.25% Pb and 0.55% Zn) including 7.80m of 717 g/t AgEq (6.13 g/t Au, 197.0 g/t Ag, 1.38% Cu, 0.49% Pb and 0.38% Zn).

Mr. Gary R. Thompson, Chairman & CEO stated, “We are extremely pleased to have discovered substantial near surface, high-grade mineralization at the largely untested Oban Breccia Zone, which is located in the heart of a 6 km mineralized corridor. Hole 60 significantly increases the potential of the property. This high-grade zone remains open at depth and on the eastern strike extensions.” Mr. Thompson further added, “We believe that the Thorn project, subject to further drilling, has the potential to host a high unit value polymetallic mineral deposit.”

OBAN BRECCIA ZONE

Hole THN11-60 was collared as the most easterly hole within the Oban drilling area at an elevation of 929m. It was drilled at an azimuth of 220 degrees with a dip of -70 degrees and to a total depth of 243.00m. THN11-60 intersected 95.08m of 1.71 g/t Au, 628 g/t Ag, 0.12% Cu, 3.31% Pb and 2.39% Zn or 904 g/t AgEq from 6.00m down hole. This included 9.25m of 3.04 g/t Au, 2,984 g/t Ag, 0.53% Cu, 11.65% Pb and 3.42% Zn or 3,646 g/t AgEq from 55.40m down hole. The entire 237.00m length of the hole was mineralized. The lower segment of THN11-60 intersected 141.92m of 53 g/t Ag, 0.16 g/t Au, 0.20% Pb and 0.47% Zn or 83 g/t AgEq from 101.08m down hole.

The mineralization is hosted by Cretaceous Oban Breccia, interpreted to be a magmatic hydrothermal breccia pipe. It is typically characterized by 5-20cm, sub-rounded to sub-angular fragments of Thorn Stock (quartz-feldspar porphyry) with lesser andesitic tuff and rhyolite fragments. The breccia is generally clast-supported with a fine-grained, dark rock flour matrix. Mineralization occurs as blebs, disseminated, chaotic sulphide stringers and sulphide rinds surrounding fragments with up to 10% pyrite, 5% boulangerite (Pb-bearing sulfosalt), 2% sphalerite, 2% other sulphosalts and minor chalcopyrite. Given the nature of the Oban breccia zone Brixton is unable to assess the true width of the high-grade intercept. Mineralization controls will be the focus of our upcoming drill programs.

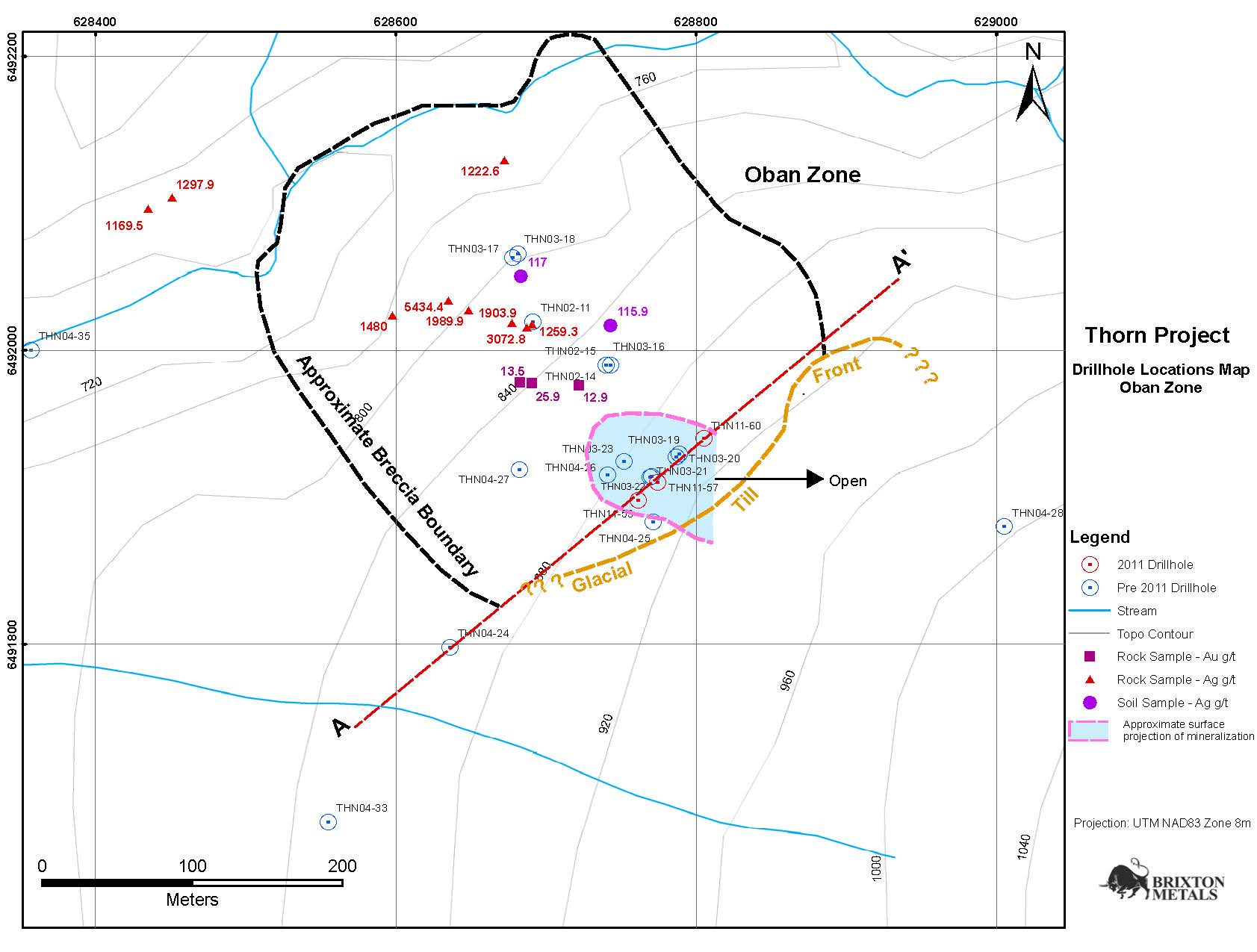

Oban Plan Map:

| Hole ID | From m | To m | Interval m | Au g/t | Ag g/t | Cu % | Pb % | Zn % | AgEq g/t |

| THN11-60 | 6.00 | 101.08 | 95.08 | 1.71 | 628 | 0.12 | 3.31 | 2.39 | 904 |

| including | 55.45 | 64.70 | 9.25 | 3.04 | 2984 | 0.53 | 11.65 | 3.42 | 3646 |

| including | 6.00 | 29.84 | 23.84 | 2.54 | 495 | 0.13 | 3.22 | 2.00 | 804 |

| including | 6.00 | 22.45 | 16.45 | 3.00 | 669 | 0.17 | 4.23 | 2.64 | 1056 |

| including | 49.44 | 75.00 | 25.56 | 2.28 | 1300 | 0.22 | 5.34 | 2.51 | 1679 |

| including | 55.45 | 75.00 | 19.55 | 2.65 | 1626 | 0.27 | 6.76 | 3.02 | 2087 |

| THN11-60 | 101.08 | 243.00 | 141.92 | 0.16 | 53 | – | 0.20 | 0.47 | 83 |

| including | 215.50 | 221.29 | 5.79 | 0.21 | 663 | – | 2.62 | 1.21 | 786 |

| including | 215.50 | 217.90 | 2.40 | 0.27 | 1177 | – | 4.68 | 2.11 | 1387 |

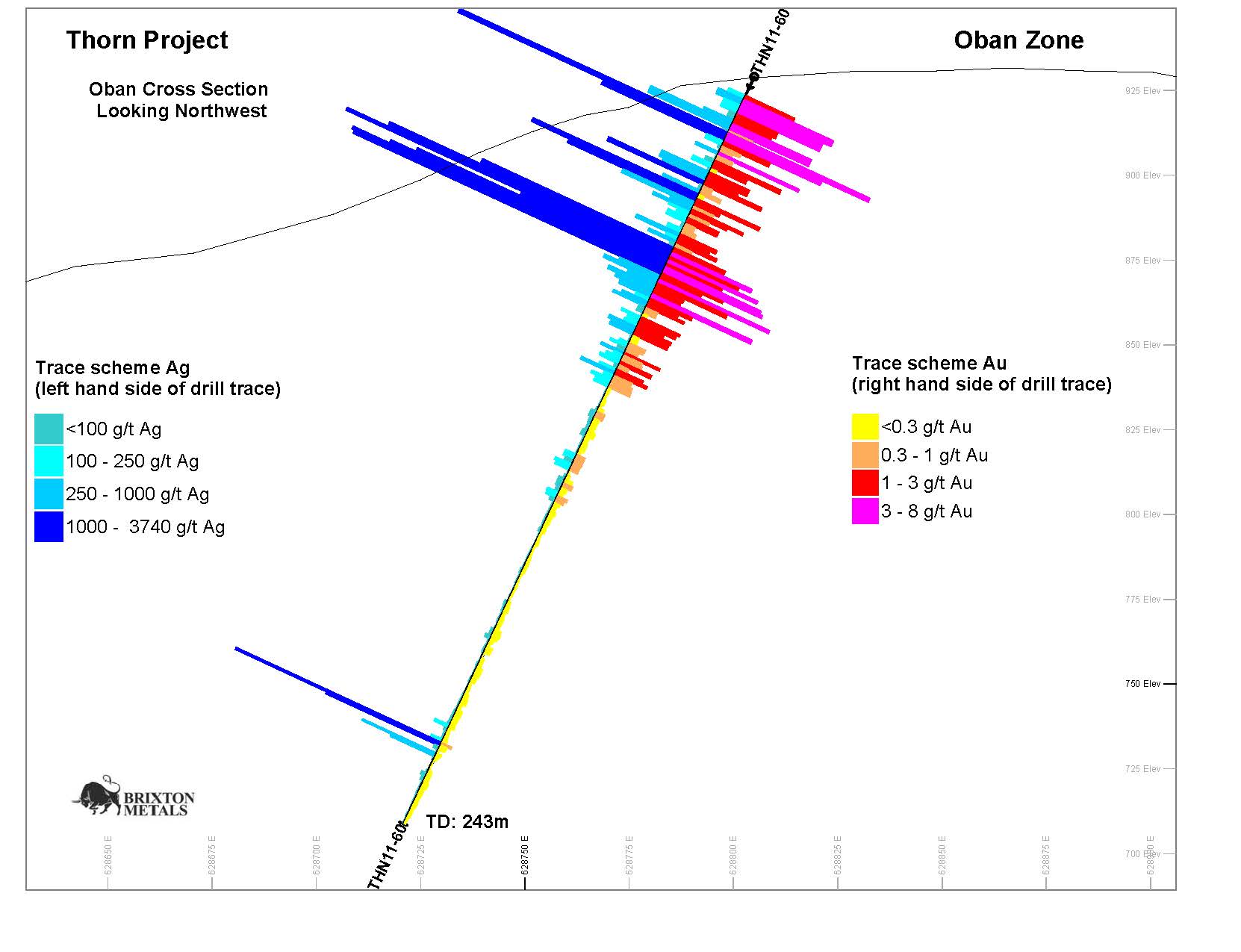

Detailed Oban Section Plots (Hole THN11-60):

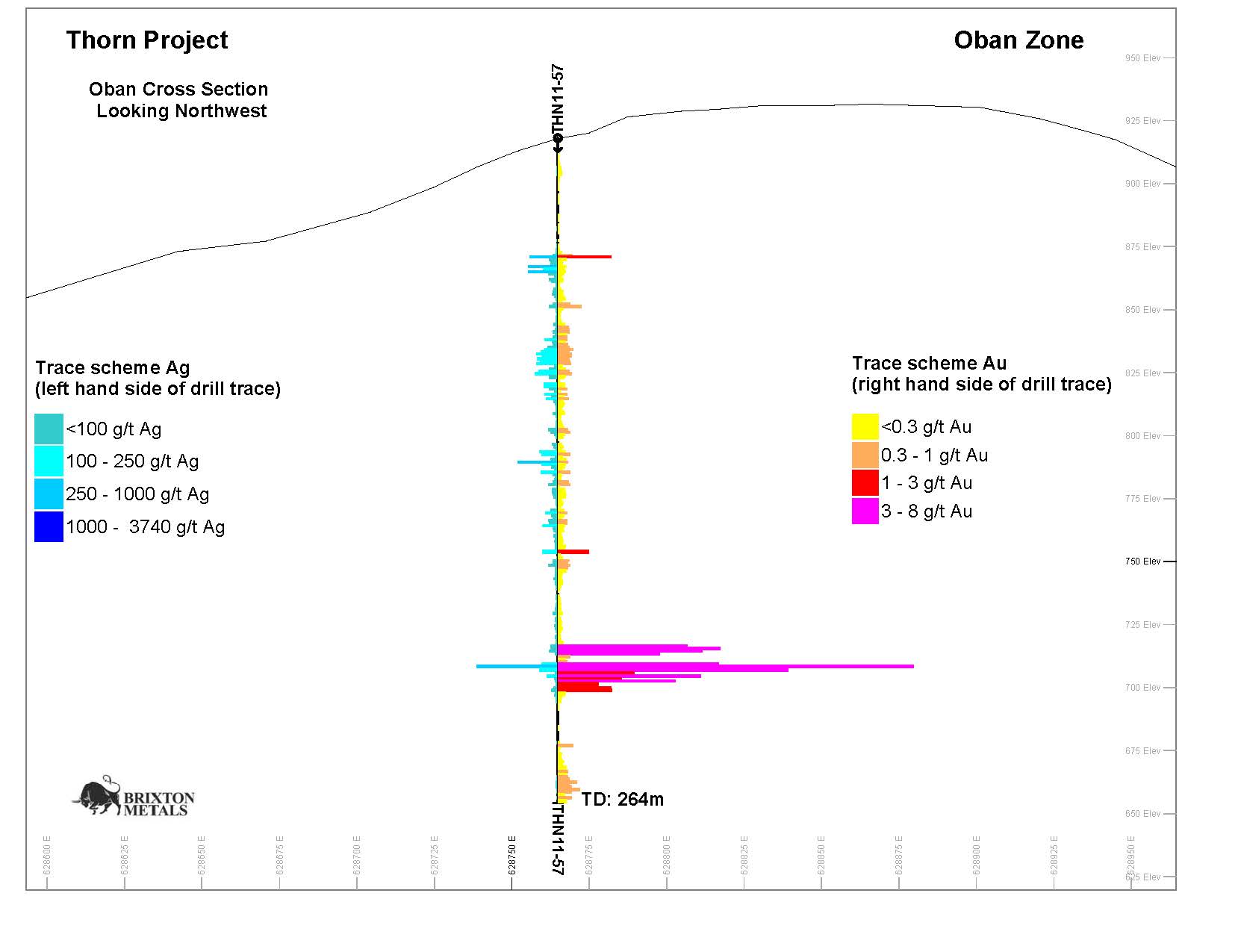

Hole THN11-57 was collared in the Oban Breccia at an elevation of 918m and was drilled as a vertical hole to a depth of 264.00m. THN11-57 intersected 103.91m of 0.26 g/t Au, 66.8 g/t Ag and 0.22% Pb and 0.63% Zn or 107 g/t AgEq from 73.39m down hole. In addition, THN11-57 intersected 37.72m of 2.08 g/t Au, 60.8 g/t Ag, 0.46% Cu, 0.25% Pb and 0.55% Zn or 252 g/t AgEq from 186.48m down hole. This 37.72m intercept included 7.80m of 6.13 g/t Au, 197.0 g/t Ag, 1.38% Cu, 0.49% Pb and 0.38% Zn or 717 g/t AgEq from 208.20m down hole.

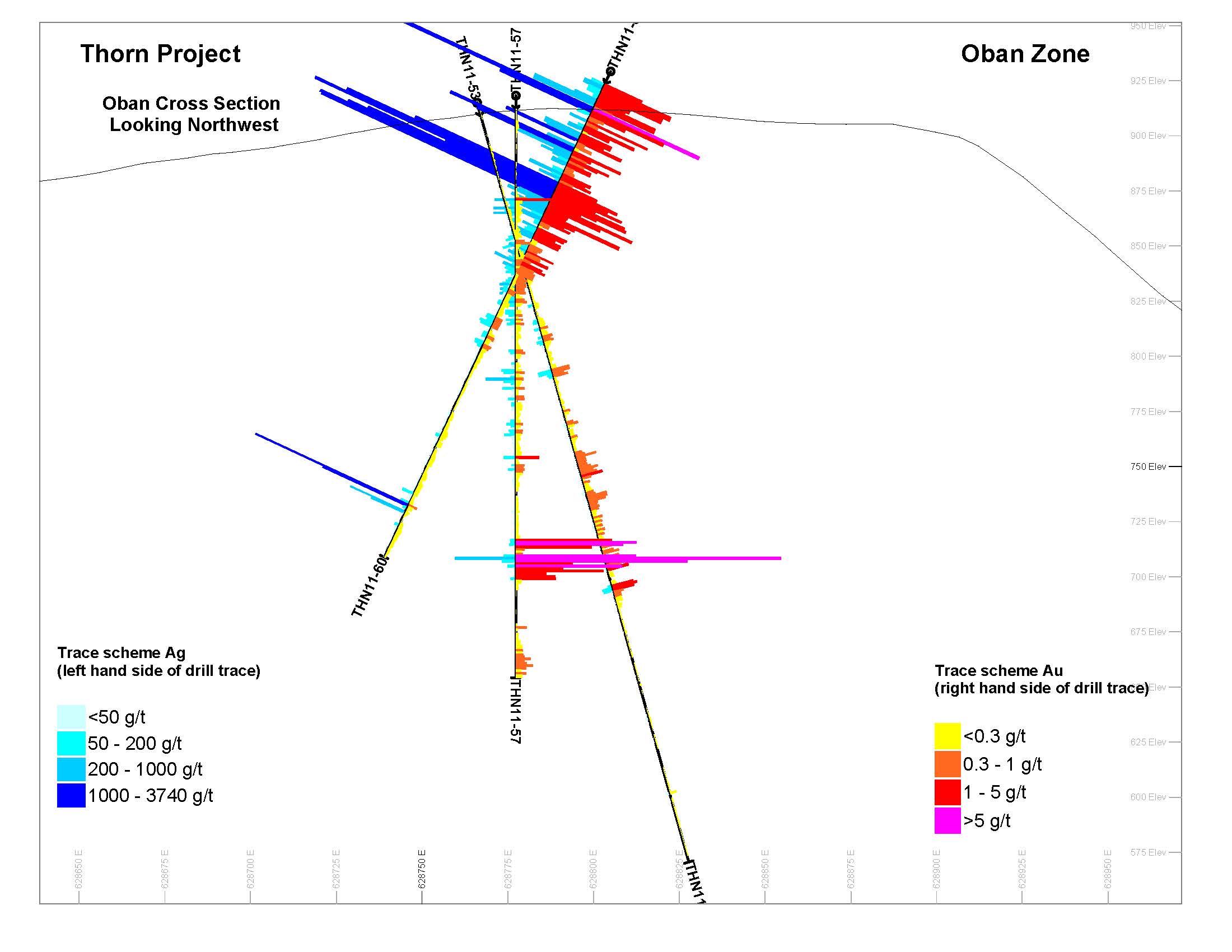

Detailed Oban Section Plots (Hole THN11-57):

| Hole ID | From m | To m | Interval m | Au g/t | Ag g/t | Cu % | Pb % | Zn % | AgEq g/t |

| THN11-57 | 46.00 | 67.39 | 21.39 | 0.31 | 89.5 | – | 0.22 | 0.27 | 121 |

| THN11-57 | 73.39 | 177.30 | 103.91 | 0.26 | 66.8 | – | 0.22 | 0.63 | 107 |

| including | 76.39 | 104.00 | 27.61 | 0.33 | 110.2 | – | 0.29 | 0.63 | 156 |

| including | 124.06 | 133.15 | 9.09 | 0.29 | 144.7 | – | 0.33 | 1.36 | 213 |

| THN11-57 | 186.48 | 224.20 | 37.72 | 2.08 | 60.8 | 0.46 | 0.25 | 0.55 | 252 |

| including | 201.00 | 219.58 | 18.58 | 4.10 | 103.0 | 0.93 | 0.33 | 0.30 | 453 |

| including | 208.20 | 219.58 | 11.38 | 4.76 | 145.7 | 1.00 | 0.41 | 0.34 | 546 |

| including | 208.20 | 216.00 | 7.80 | 6.13 | 197.0 | 1.38 | 0.49 | 0.38 | 717 |

| THN11-57 | 240.53 | 264.00 | 23.47 | 4.44 | 0.3 | 0.07 | – | 0.09 | 255 |

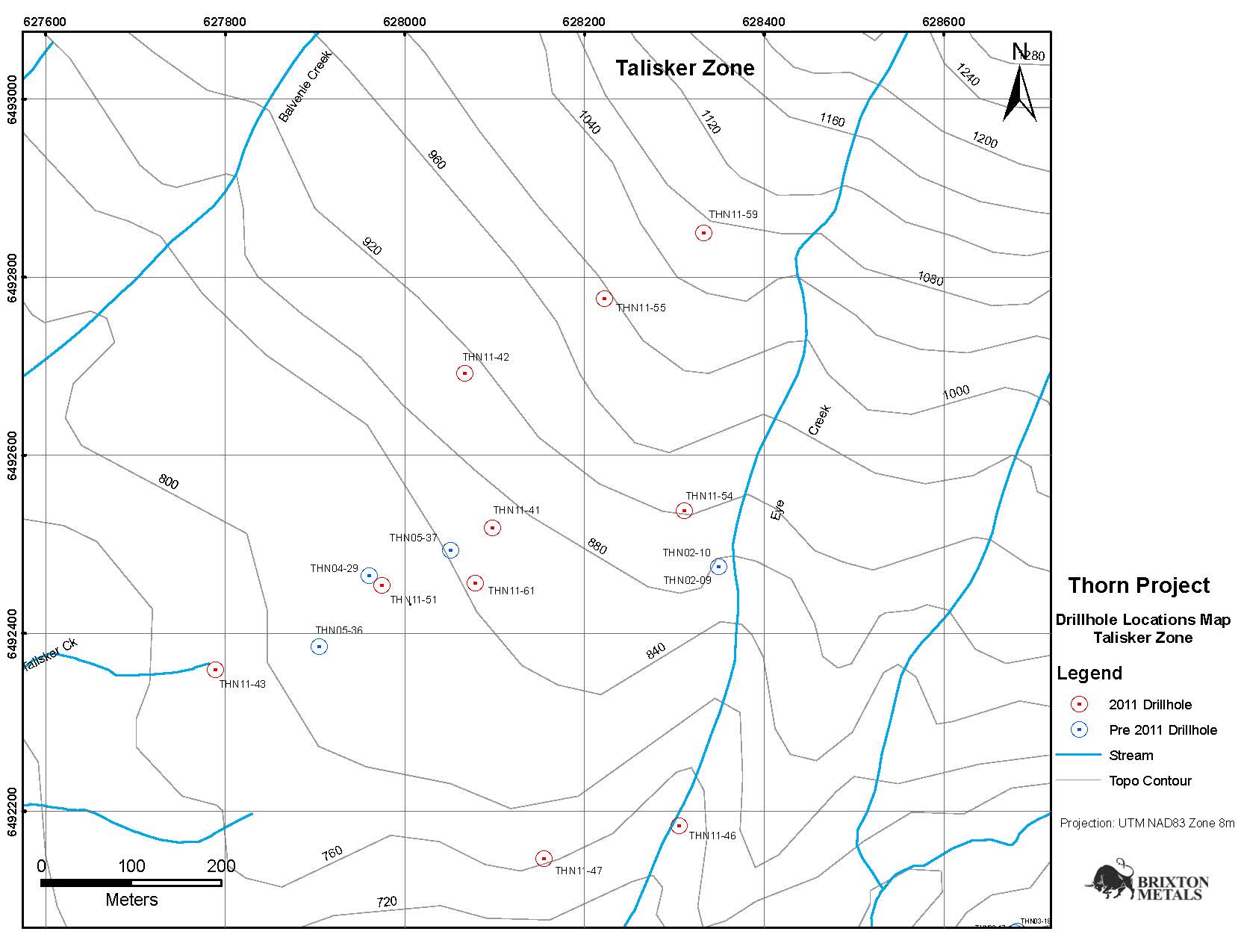

TALISKER ZONE

Hole THN11-56 was designed to target the northeast extension of the Talisker Zone and secondly, to test the unconformity-related mineralization (Thorn Stock and overlying volcanic rock contact). The hole was collared at an elevation of 1,005m and was drilled at an azimuth of 145 degrees with a dip of -70 degrees. THN11-56 intersected 19.78m of 1.02 g/t Au, 35.5 g/t Ag, and 0.30% Cu or 2.4 g/t AuEq (134 g/t AgEq) from 82.30m down hole including 0.90m of 12.35 g/t Au, 138.0 g/t Ag and 0.49% Cu or 15.8 g/t AuEq (875 AgEq) from 93.59m down hole. The mineralization starting at 82.30m is hosted at the unconformity contact indicating that this geological feature is an important gold and silver target due to its lateral extent potential.

Talisker Drill Plan Map:

| Hole ID | From m | To m | Interval m | AuEq g/t | Au g/t | Ag g/t | Cu % | Pb % | Zn % | AgEq g/t |

| THN11-56 | 82.30 | 102.08 | 19.78 | 2.4 | 1.02 | 35.5 | 0.30 | 0.17 | 0.14 | 134 |

| Including | 93.59 | 94.49 | 0.90 | 15.8 | 12.35 | 138.0 | 0.49 | – | – | 878 |

| THN11-56 | 115.34 | 119.64 | 4.30 | 1.3 | 0.31 | 30.4 | – | 0.20 | 0.52 | 70 |

| including | 150.27 | 152.27 | 2.00 | 2.7 | 1.02 | 54.6 | 0.17 | 0.19 | 0.36 | 147 |

Hole THN11-61 was collared at an elevation of 860m and was drilled at an azimuth of 325 degrees and a dip of -50 degrees. This hole was designed to test for down-dip mineralization of the historic hole THN05-37 which intersected 4.00m of 4.44 g/t Au, 407.9 g/t Ag and 2.95% Cu or 984 g/t AgEq. Hole THN11-61 intersected 2.02m of 1.4 g/t Au, 52.4 g/t Ag and 0.75% Cu or 230 g/t AgEq.

Holes THN11-59 and THN11-58 returned insignificant results.

Silver Equivalent (AgEq) values were calculated using $1,088 per ounce of gold, $19.62 per ounce of silver, $3.20 per pound of copper, $0.80 per pound of lead, $0.90 per pound of zinc and 100% metal recoveries assumed.

AgEq = Ag g/t + (Au g/t x 34.98/0.63) + (Cu% x 70.55/0.63) + (Pb% x 17.64/0.63) + (Zn% x 19.84/0.63)

Quality Assurance & Quality Control

The Thorn Project was managed by Equity Exploration Consultants Ltd. Stewart Harris, P.Geo. is Equity’s in-house QAQC expert who conducted a detailed QAQC analysis of the 2011 analytical results. Drill core samples were packed into rice sacks and sealed with uniquely-numbered straps to deter and identify evidence of tampering. Rice sacks were shipped via Small’s Expediting to the ALS Laboratory Group (ALS) preparation lab in Whitehorse, YT which has been certified compliant with ISO9001:2008 requirements. All standards fell within control limits and blank samples fell within acceptable detection limits.

Toby Hughes, P. Geo., is the Qualified Person as defined under National Instrument 43-101 standards and has reviewed and approved this News Release.

About The Thorn Project

The 19,000-hectare Thorn Property is located in the Sutlahine River area of northwestern British Columbia, Canada. The Thorn project exploration is focused on a network of high sulphidation epithermal veins and breccia zones and shares many similarities with other high sulphidation epithermal gold, silver and copper deposits around the world, including La Bodega in Colombia, Lepanto in the Philippines and El Indio in Chile.

The geology of the Thorn project is a Cretaceous aged porphyry complex. Several porphyry intrusive phases and related breccia zones outcrop on the property. In addition to the high-grade potential of the Thorn project, potential exists for large tonnage porphyry targets. The Oban Zone is located in the heart of a 6 km mineralized corridor. Brixton Metals Corporation holds a two-phase option agreement with Rimfire Minerals Corporation (now Kiska Metals Corporation). Brixton can earn either a 51% or 65% interest by making cash and share payments and incurring $5 million and $10 million in exploration expenditures respectively. Kiska may elect to form a Joint Venture with Brixton at the 49/51 or 35/65 stage, or take dilution. Brixton shall be the operator in either case.

Kahilt Update

Brixton also announced that it will allow its option to acquire a 100% interest in its Kahilt property to lapse (the “Alaskan Property”). The Alaskan Property is governed by an option agreement between the Company and Millrock Resources Inc. (“Millrock”) dated October 14, 2010, as amended. Brixton is also transferring certain claims staked by the Company to Millrock. After careful consideration of assay results and the Company’s assessment of the stage of the Alaskan Property, management and the Board of Directors has determined that the company shall focus its resources on the Thorn property. As of December 31, 2011, Brixton had no further financial or other commitments under the Millrock option agreement.

About Brixton Metals

Brixton is an exploration company engaged in the acquisition and exploration of precious metal assets. Brixton’s management is focused on advancing large-scale metal deposits to feasibility. The Thorn Project is Brixton’s flagship property and is centred on a network of gold-silver-copper-lead-zinc-bearing vein corridors and breccia zones. The Thorn property is located in northwestern British Columbia, Canada and about 50 km from the past producing Golden Bear Mine and 130 km southwest from the village of Atlin, BC. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB and its warrants trade under the symbol BBB.WT. For more information about Brixton please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, P.Geo, Chairman and CEO

(604) 630-9707

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. All statements, other than statements of historical fact, included herein including, without limitation are forward looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSX-V and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.