July 7, 2020 – Brixton Metals Corporation (TSXV: BBB) (the “Company” or “Brixton”) announces initial drill results from its maiden drill program at is wholly owned Hog Heaven Project, which returned multiple significant intervals of high-grade silver, gold and copper mineralization. A total of seven holes representing 1,400.35 metres were drilled of HQ sized core.

Chairman and CEO of Brixton, Gary R. Thompson stated, “We are very pleased to have successfully completed our maiden drill program at the Hog Heaven Project. The new, strategic approach under Brixton is to define a compliant resource on the high-grade silver-gold-copper targets as a near term underground operation versus the historic mine plan, which was an open pit mine plan. Based on these results and our preliminary interpretation of the remaining holes, we plan to complete a Phase II exploration program at the Hog Heaven Project later this summer.”

The purpose of this drilling program was to validate historical results from the 1970’s and 1980’s at the Main Mine area. High grade mineralization was encountered in all of the holes drilled.

Highlights of Hole HH20-02

- Drill hole HH20-02 intersected a broad 224.85m zone of mineralization for 78.16 g/t Ag, 0.66 g/t Au, 0.24% Cu (75.07m-299.92m) which includes the following:

- 5.48m of 445.79 g/t Ag, 1.41 g/t Au, 1.50% Cu

- 2.13m 0f 917.36 g/t Ag, 2.00 g/t Au, 3.06% Cu

- 53.49m of 165.90 g/t Ag, 1.28 g/t Au, 0.55% Cu

- 13.56m of 185.80 g/t Ag, 2.24 g/t Au, 0.76% Cu

- 1.37m of 1,750 g/t Ag, 5.39 g/t Au, 2.65% Cu

Brixton plans to discuss these results, along with the ongoing work at its Thorn Project, in a webinar on Tuesday, July 7th at 2pm EST (11am PST). Please register here (https://www.redcloudfs.com/rcwebinar-bbb-2/)

High grades emerged within the hole as two distinct Upper and Lower Zones.

The Upper Zone interval of 36.18 metres is from 75.07 metres to 111.25 metres depth. Several semi-massive to massive sulphide mineralization within a latite porphyry dyke and along its brecciated margins. Specific high-grade intervals within the Upper Zone include 5.48 metres of 445.79 g/t Ag, 1.41 g/t Au, and 1.50% Cu, including 2.13 metres of 917.36 g/t Ag, 2.00 g/t Au, 3.06% Cu.

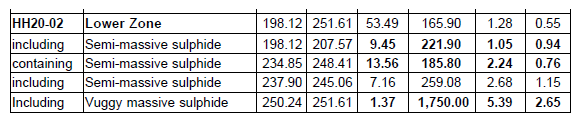

The Lower Zone interval of 53.49 metres is from 198.12 metres to 251.61 metres, encountered in the sediment-hosted unit, a newly-recognized mineral style at Hog Heaven. In this zone, mineralization is strata-bound within pebble conglomerates and occurs over numerous semi-massive to massive and vuggy replacement horizons. In total the Lower Zone 53.49 metre interval returned 165.90 g/t Ag, 1.28 g/t Au, 0.55% Cu. Several high-grade intervals within the zone returned 9.45 metres assaying 221.90 g/t Ag, 1.05 g/t Au, and 0.94% Cu; 0.32 metres assaying 1,010 g/t Ag, 7.47 g/t Au, and 0.64% Cu; and 13.56 metres assaying 185.80 g/t Ag, 2.24 g/t Au, and 0.76% Cu. An additional massive sulphide horizon from the Lower Zone assayed 1.37m of 1,750.00 g/t Ag, 5.39 g/t Au, and 2.65% Cu.

Table1. Drill hole HH20-02 of Mineralized Intervals as Composite Weighted Average Assays.

The assay intervals reported are uncut weighted averages and true widths cannot be determined at this time. Hole HH20-02 was drilled as a vertical hole to a depth of 299.92 metres.

Brixton recognizes the potential for the Hog Heaven Project to host a cluster of mineralized systems. Results from the recent soil sampling and other recently completed drill holes on the Hog Heaven Project will be released when they have been received and analyzed by the Company.

At least three primary target areas have been identified for further drilling: the Main Mine, WF-Ole Hill area and Martin Mine area. The project has affinity for strata-bound Cu-Ag deposits, high-sulphidation Ag-Au-Cu deposits and porphyry Cu-Au deposits.

Quality Assurance and Quality Control

As a matter of procedure, the mineralized intervals of drill core were split in the field using an electric-powered core saw, bagged, and delivered to ALS Chemex Laboratories in Vancouver for analysis. In addition to the laboratory’s quality control program, a rigorous on-site quality assurance and quality control program was implemented, which involved the insertion of blanks, standards and splits to ensure reliable assay results. The standards, blanks and duplicate assays were found to fall within acceptable limits, supporting the precision and accuracy of the reported results. The QAQC was conducted by an independent third-party, Mr. Scott Close, P.Geo., Principal of Ethos Geological Inc., who is a qualified person as defined by National Instrument 43-101, and who reviewed and approved the information in this press release.

Chairman and CEO of Brixton, Gary R. Thompson further stated, “The Company has accepted the resignation of Mr. Sorin Posescu, VP Exploration for the Company. On Behalf of everyone at Brixton I wish to thank Mr. Posescu for his work over the past decade and wish him the best in his future endeavors.”

Effectively immediately, Mr. Mitchell Smith has been promoted to Vice President of Investor Relations for the Company.

About Brixton Metals Corporation

Brixton is a Canadian exploration and development company focused on the advancement of its mining projects toward feasibility. Brixton wholly owns four exploration projects, the Thorn copper-gold-silver Project, the Atlin Goldfields Projects located in NWBC, the Langis-HudBay silver-cobalt Project in Ontario and the Hog Heaven silver-gold-copper Project in NW Montana, USA. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB. For more information about Brixton please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

Tel: 604-630-9707 or email: info@brixtonmetals.com

For Investor Relations please contact Mitchell Smith at mitchell.smith@brixtonmetals.com or 604-630-9707

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds, By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.