July 29, 2014 – Brixton Metals Corporation (TSXV: BBB) (the “Company” or “Brixton”) is pleased to announce results from its 2014 exploration program at its 100 percent owned Thorn project. Brixton completed eight NQ sized core drill holes for a total of 1,287 metres within two separate areas of the property. Drilling was focused on the Glenfiddich (464 metres in 4 holes) and Outlaw zone (823 metres in 4 holes). A total of 396 drill core specific gravity measurements were collected from the Oban, Talisker, Glenfiddich and Outlaw zones.

Highlights of Results

- Discovery of a new sediment hosted gold zone at Outlaw: Hole 128 returned 59.65 metres of 1.15 g/t Au and 5.64 g/t Ag from 76.00 metres depth. Including 9.00 metres of 3.08 g/t Au and 10.77 g/t Ag.

- Surface mineralization: Hole 127 located 283 metres west of hole 128; returned 11.58 metres of 1.96 g/t Au and 13.78 g/t Ag.

- Mineralization is hosted by siltstone to greywacke and appears to be intrusion related.

- Elevated silver, arsenic and bismuth elements are associated with the gold mineralization.

- Multi-kilometer exploration upside potential is supported by gold-geochem, geology and magnetics.

Chairman and CEO of Brixton, Gary Thompson stated, “The recent drilling at Thorn adds a fourth zone and perhaps its most significant gold zone on the property to date. Silver-gold diatreme breccia (Oban Zone), veins (Talisker-Glenfiddich zones) and intrusion related sediment hosted gold (Outlaw) zones now exist at the Thorn property”. Mr. Thompson further stated that “Brixton represents a very attractive exploration upside opportunity. As a previously stated in the Company’s News Release May 8, 2014, Brixton has engaged SRK Consulting to provide an independent inferred resource estimate for its Oban, Talisker and Glenfiddich zones, which is due 2014”.

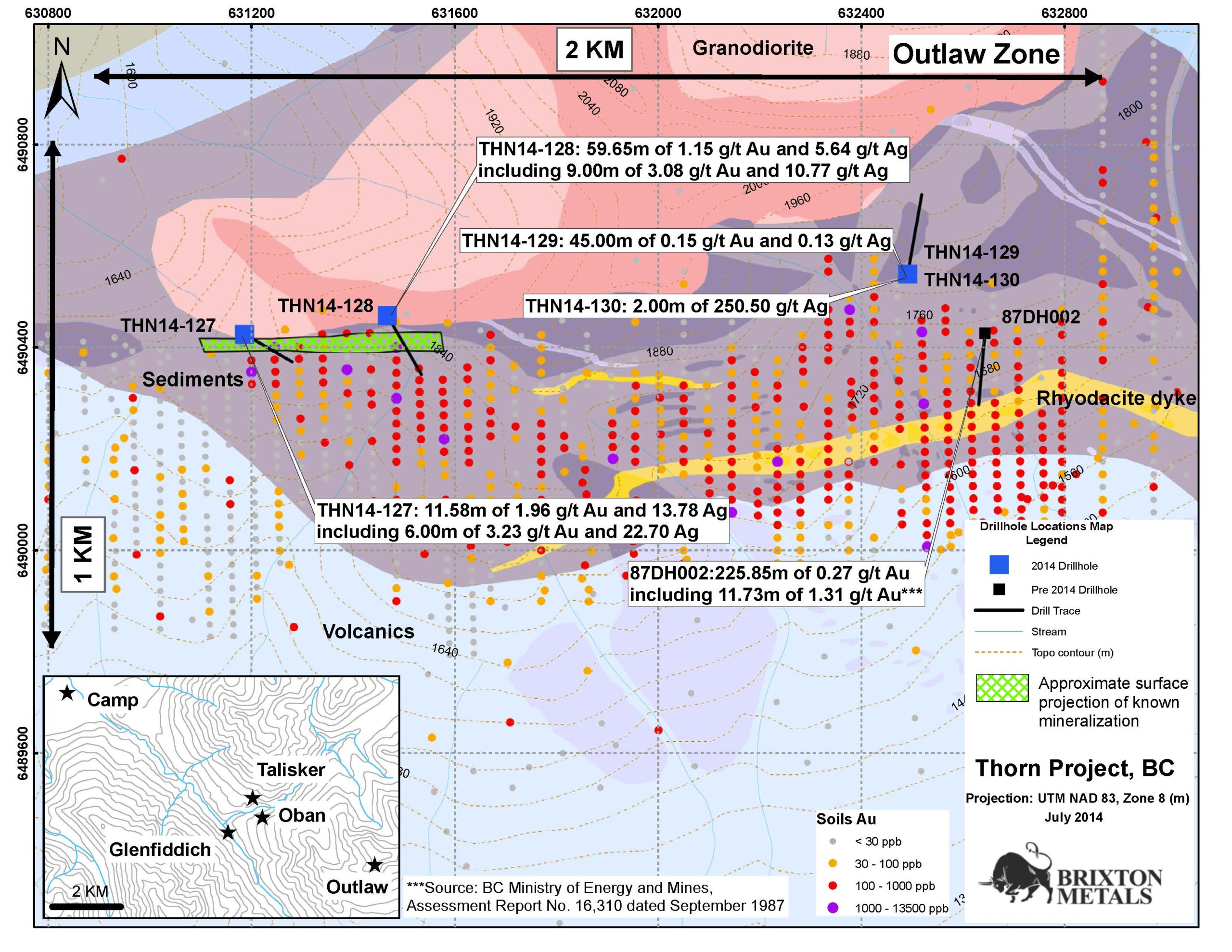

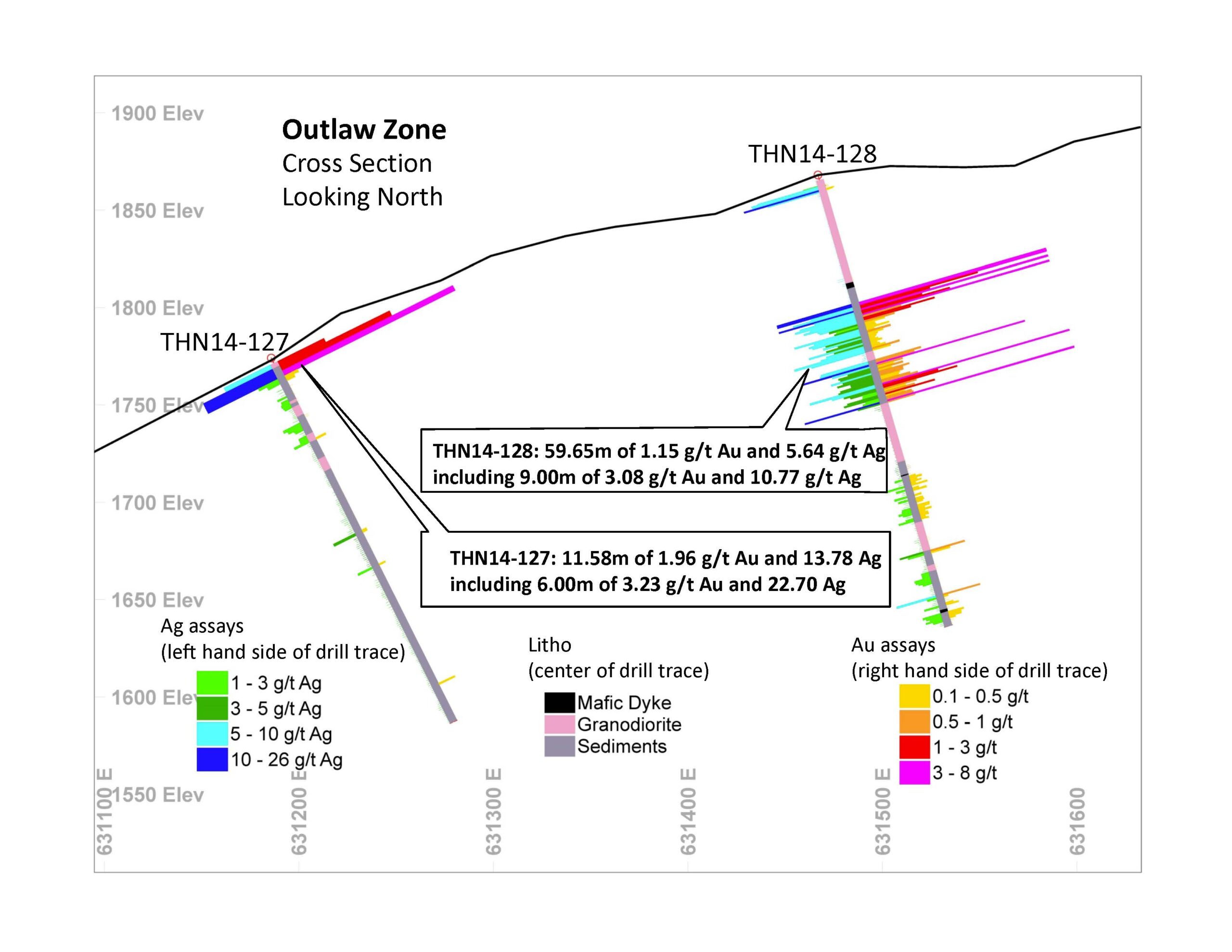

Holes 127 to 130 were drilled to test the gold in soil anomaly at the Outlaw zone. THN14-127 returned 11.58 metres of 1.96 g/t Au and 13.78 g/t Ag from 3.05 metres. Included in this interval was 6.00 metres of 3.23 g/t Au and 22.70 g/t Ag from 5.50 metres depth.

Drill location maps:

Hole 128 was collared 283 metres to the east from hole 127. Hole 128 returned 59.65 metres of 1.15 g/t Au and 5.64 g/t Ag including 9.00 metres of 3.08 g/t Au and 10.77 g/t Ag from 76.00 metres depth. Mineralization is hosted within interbedded siltstone and greywacke. Primary sulphides are pyrrhottite, pyrite and lesser bismuth, chalcopyrite which occur as semi-massive to disseminated and veinlets. See core photos at the link below. The strata appears to generally strike east/west and has a moderate north dip.

Hole 128 core photos:

Hole 128 core photos (close-up):

Outlaw Zone Drill Results:

| Hole ID | From | To | Interval | Gold | Silver | AuEq | ||||||

| (metre) | (metre) | (metre) | g/t | g/t | g/t | |||||||

| THN12-127 | 3.05 | 14.63 | 11.58 | 1.96 | 13.78 | 2.21 | ||||||

| including | 5.50 | 11.50 | 6.00 | 3.23 | 22.70 | 3.63 | ||||||

| THN14-128 | 76.00 | 135.65 | 59.65 | 1.15 | 5.64 | 1.25 | ||||||

| including | 76.00 | 85.00 | 9.00 | 3.08 | 10.77 | 3.27 | ||||||

| THN14-128 | 179.00 | 205.00 | 26.00 | 0.16 | 0.96 | 0.18 | ||||||

| THN14-129 | 64.00 | 109.00 | 45.00 | 0.15 | 0.13 | 0.15 | ||||||

| THN14-130 | 8.00 | 10.00 | 2.00 | – | 250.50 | 4.53 |

Outlaw drill cross-section:

AuEq = Au g/t + Ag g/t (0.63/34.98).

Gold equivalent (AuEq) values were calculated using $1,088 per ounce of gold, $19.62 per ounce of silver with 100% metal recoveries assumed.

Holes 129 and 130 were drilled from the same pad at an elevation of 1,812 metres. THN14-129 was drilled vertically but was abandoned at 115.21 metres depth due to difficult ground conditions. THN14-130 was drilled at an azimuth of 10 degrees and a dip of – 45 degrees and to a depth of 224.94 metres. Please see the above table for results. Most significant was 2.00 metres of 250.50 g/t Ag in hole THN14-130 from 8 metres depth.

Holes 123-126 were drilled at the Glenfiddich zone. Holes 123 and 124 were drilled to test the extent of mineralization on strike and to the Northwest, while holes 125 and 126 were drilled to confirm the 1986 drill holes. This was done in an attempt to acquire enough data to include the zone in an inferred estimate. Drill results are tabled below. Generally higher grades in the Glenfiddich zone are hosted in vein/breccia. Please see the table below and maps to see drill hole locations.

Glenfiddich Zone Drill Results:

| Hole ID | From | To | Interval | Gold | Silver | Copper | Lead | Zinc | AgEq | ||||

| (metre) | (metre) | (metre) | g/t | g/t | % | % | % | g/t | |||||

| THN14-123 | 68.00 | 76.00 | 8.00 | 1.26 | 12.11 | 0.05 | – | 0.05 | 89.18 | ||||

| THN14-124 | 17.50 | 29.13 | 11.63 | 0.57 | 7.54 | – | 0.08 | 0.22 | 50.23 | ||||

| THN14-124 | 45.00 | 58.37 | 13.37 | 0.35 | 10.85 | 0.14 | 0.02 | 0.03 | 46.95 | ||||

| THN14-125 | 6.10 | 73.00 | 66.90 | 0.30 | 17.03 | 0.11 | 0.08 | 0.19 | 53.77 | ||||

| including | 46.00 | 49.00 | 3.00 | 2.13 | 70.97 | 0.72 | – | – | 271.46 | ||||

| THN14-126 | 17.00 | 54.00 | 37.00 | 0.48 | 14.76 | – | 0.06 | 0.12 | 51.47 | ||||

| including | 43.00 | 44.00 | 1.00 | 4.10 | 58.10 | 0.13 | 0.09 | 0.29 | 311.69 |

AgEq = Ag g/t + (Au g/t x 34.98/0.63) + (Pb% x 17.64/0.63) + (Zn% x 17.64/0.63) + (Cu% x 70.55/0.63)

Silver equivalent (AuEq) values were calculated using $1,088 per ounce of gold, $19.62 per ounce of silver, $3.20 per pound of copper, $0.80 per pound of lead and $0.80 per pound of zinc with 100% metal recoveries assumed.

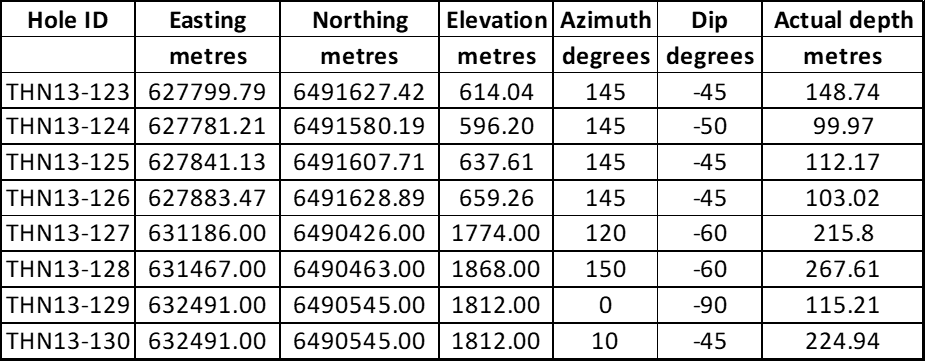

A table of collar information:

Quality Assurance & Quality Control

Mr. Sorin Posescu, P.Geo., VP Exploration prepared a QAQC protocol for the Company and oversaw sampling procedures. Ms. Caroline Vallat, P.Geo., from GeoSpark Consulting Inc. conducted an independent QAQC review which returned overall strong accuracy and precision of the analytical results. Sealed samples were shipped by the Company geologists to ALS Minerals preparation lab in Whitehorse, Yukon. ALS Minerals Laboratories are registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Blank, duplicate and certified reference materials were inserted into the sample stream. Analysis for gold was done by Fire Assay with AA finish. All other elements were analyzed by Aqua Regia Digest with ICP-AES finish. Silver over-limits were analyzed by fire assay with gravimetric finish. Base metal over-limits were analyzed with Aqua Regia Digest and AA finish. A copy of the QAQC protocols can be viewed at the Company’s website.

All reported assays are uncut weighted averages. The true width of reported mineralization is unknown at this time.

Mr. Sorin Posescu, P.Geo., VP Exploration, is a Qualified Person as defined under National Instrument 43-101 standards and has reviewed and approved this news release.

About Brixton Metals and its Thorn Project

Brixton is an exploration company focused on the advancement of high-grade precious metal assets to feasibility. Brixton’s Thorn project hosts a district scale Triassic to Cretaceous volcanoplutonic complex with several styles of mineralization related to porphyry and epithermal environments. Targets include high-grade silver-gold-lead-zinc-bearing diatreme-breccia zones, high-grade gold-silver-copper veins, porphyry copper-gold-silver and intrusion related sediment hosted gold. The 28,000-hectare Thorn Project is located in the Sutlahine River area of Northwestern British Columbia, Canada, approximately 105 km ENE from Juneau, AK.

Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB. For more information about Brixton please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO,

Tel: 604-630-9707 info@brixtonmetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the proposed exploration, sampling and drilling at Thorn and statements concerning the anticipated results of such exploration work, are forward looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSX-V and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.