December 19, 2019 – Brixton Metals Corporation (TSXV: BBB) (OTCQB: BBBXF) (the “Company” or “Brixton”) is pleased to announce final analytical results from its 2019 phase two exploration program at its wholly owned Thorn Project located in the Golden Triangle of British Columbia. The analytical results reported below are from a total of ten core holes, which is the balance of the 2019 program. Six core holes were drilled at the Chivas Porphyry target, two core holes were drilled at the Camp Creek Copper Corridor Porphyry target, one core hole was drilled at the Talisker Zone and one core hole at the Outlaw Zone, a sediment hosted gold target.

2019 Highlights:

- 2019 drilling further supports a district-scale opportunity at the Thorn Project, showing metal zoning similar in scale and arrangement with large porphyry Cu(Au-Mo) systems worldwide

- Intersections of porphyry-style Cu-Au-Mo mineralization in multiple 2019 drill holes in the Camp Creek Corridor:

- THN19-150 (Oban): 554.70 m at 1.97 g/t AuEq (97.00-651.70 m)

- THN19-151 (Oban): 256.87 m at 2.31 g/t AuEq (100.18-357.05 m)

- THN19-162 (Glenfiddich): 230.82 m at 0.27% CuEq (323.00-553.82 m)

- Drill hole THN19-162 intersected Cu-Au-Ag-Mo mineralization as follows:

- 230.82m of 0.16% Cu, 0.08 g/t Au, 0.011% Mo and 1.90 g/t Ag or 0.27% CuEq from 323.00m depth with increasing Cu and Mo grades at depth

- Including 91.00m of 0.21% Cu, 0.09 g/t Au, 0.015% Mo and 2.43 g/t Ag or 0.35% CuEq from 425.00m depth

- Including 59.25m of 0.22% Cu, 0.11 g/t Au, 0.015% Mo and 2.59 g/t Ag or 0.38% CuEq from 456.75m depth

- Further drilling at the Outlaw Zone confirms broad intervals of gold mineralization:

- Drill hole THN19-160 intersected 32.05m of 0.50 g/t Au from 23.95m depth including 2.00m of 5.01 g/t Au from 54.00m depth

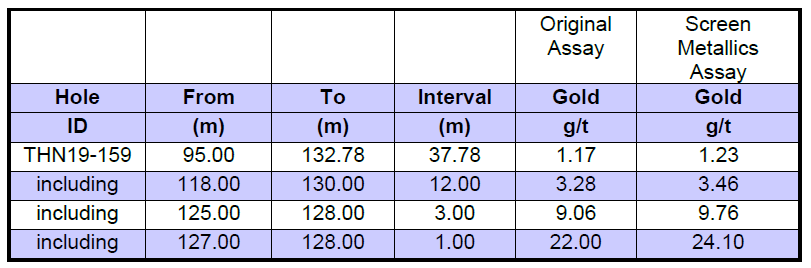

- Drill hole THN19-159 intersected 37.78m of 1.23 g/t Au from 95.00m depth including 12.00m of 3.46 g/t Au (gold assays adjusted after screen metallic analysis)

Chairman and CEO of Brixton Metals, Gary R. Thompson stated, “The 2019 exploration season for Brixton was an exciting one, which started with one of the deepest and best core holes ever on the Thorn Project resulting in more than a half kilometre of mineralization. Drill hole 150, which was drilled at the Oban diatreme, included 135.96m of 5 g/t AuEq. Drill hole 162 was collared 1 kilometre west of hole 150 and is the first porphyry style mineralization that has been drilled in the Camp Creek area. We are encouraged that the grades in hole 162 are increasing with depth and ended in mineralization. The Camp Creek Copper Corridor has all the porphyry hallmark indicators of a large mineralized system. The Camp Creek target is a buried porphyry target that will take more work including geology, geophysics, geochemistry and deep drilling to locate the center of the system.” See Figure 11 which shows the current work area in relation to the size of the claim block.

Mr. Thompson continued, “Following the recent financings, Brixton expects to finish the year with about C$5.6 million and is well positioned to continue advancing Thorn along with its other projects for the benefit of our shareholders. We are still reviewing the data from the 2019 work programs at all of our projects and plan to release our 2020 exploration plans early next year.”

Thorn Project Porphyry Target Highlights:

- Multiple phases of texturally and chemically Cu-fertile porphyry phases are present. Textural favourability is indicated by ‘crowded’ plagioclase and hornblende phenocrysts and thick biotite books; chemical fertility by high Sr/Y ratios, a recognized signal of porphyry Cu-related intrusions worldwide.

- High-grade veins containing enargite and/or other sulphosalts are common in parts of the Camp Creek Corridor like drill hole THN13-121, which returned 1.1 m true thickness of 10.62% Cu, 583 g/t Ag and 2.55 g/t Au from 74.4m depth. Vein grab samples from Camp Creek have returned up to 66 g/t Au, 32.8% Cu and 2,900 g/t Ag; however, these grab samples are not representative throughout the property, but similar veins closely overlie porphyry Cu shells at other deposits.

- Fragments containing chalcopyrite-and/or molybdenite-mineralized porphyry-style veins are present in the Oban breccia. They were likely derived from porphyry mineralization at depth and transported upward by the explosive brecciation process (Sillitoe, 1985).

Figure 1. Drill Location Plan Map

Camp Creek Copper Corridor Drilling Summary

The 2019 phase two program objective was to conduct a deep seeing to about one kilometre depth DCIP-MT geophysical survey across the Camp Creek trend to identify drill targets. Unfortunately, due to a late start of the survey and the early onset of winter conditions, less than half of the proposed survey lines were completed (9km of the 20km). Drilling at Camp Creek Target consisted of a total 1,308m within three holes with the objective to test for porphyry related mineralization. Drill hole 162 was located about 1 kilometre west from hole 150. Hole 162 was successful in intersecting porphyry style copper-gold-molybdenum-silver mineralization over significant widths. Mineralization is hosted in a diorite porphyry Thorn stock and consists generally in disseminated sulphides. Drill hole 162 was drilled below the high sulphidation part of the system that was intersected by previous drilling at the Glenfiddich Zone where THN13-121 returned 1.1 m true thickness of 10.62% Cu, 583 g/t Ag and 2.55 g/t Au from 74.4m depth.

Figure 2. HQ Core THN19-162 From 410.70m depth

Figure 3. THN19-162 Chalcopyrite/Pyrite Mineralization at 480m Depth

Figure 4. HQ Core THN19-162, From 406.95m to 416.66m Depth

The most significant porphyry related mineralization interval in drill hole 162 occurs from 323.00m to 553.82m where analytical results returned 230.82m of 0.16% Cu, 0.08 g/t Au, 0.011% Mo and 1.90 g/t Ag or 0.27% CuEq. Importantly, it appears that porphyry style Cu-Mo mineralization increases with depth (see Figure 6. Hole 162 Graphic Log).

Table 1a. Composite Assays for THN19-162

All reported assays are uncut weighted averages and represent drilled core lengths. The true width of reported mineralization is unknown at this time. Copper Equivalent values (CuEq) were calculated using formula CuEq = ($1250 x Au g/t ÷ 31.10+ $15.40 x Ag g/t ÷ 31.10 + $2.80 x % Cu ÷ 100 x 2204.63 + $11.79 x % Mo ÷ 100 x 2204.63) ÷ ($2.80 ÷ 2204.62 x 100)

Table 1b. Composite Assays for THN19-162

All reported assays are uncut weighted averages and represent drilled core lengths. The true width of reported mineralization is unknown at this time. Gold Equivalent values (AuEq) were calculated using formula AuEq = ($1,250.00 x Au g/t ÷ 31.10 + $15.40 x Ag g/t ÷ 31.10 + $0.90 x % Pb ÷ 100 x 2204.63 + $1.25 x % Zn ÷ 100 x 2204.63) ÷ $1,250 x 31.10

Figure 5. Camp Creek Drill Location Plan Map

Figure 6. Drill Hole THN19-162 Graphic Log

Figure 7. Camp Creek Cross Section

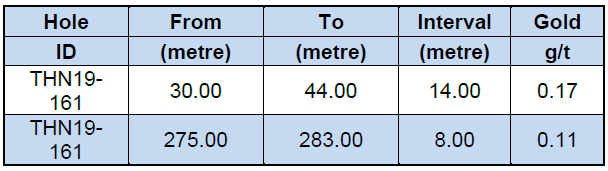

Drill hole 161 was drilled at the Talisker Zone and was designed to test for down-dip extension of the gold-copper-silver mineralization intersected in hole THN11-51 (News Release dated October 25, 2011: THN11-51 intersected 49.78 m of 1.41 g/t Au, 19.0 g/t Ag and 0.25% Cu or 2.26 g/t AuEq.) Best mineralized interval in hole 161 was 14.00m of 0.17 g/t Au from 30.00m.

Table 2. Composite Assays for THN19-161

All reported assays are uncut weighted averages and represent drilled core lengths. The true width of reported mineralization is unknown at this time.

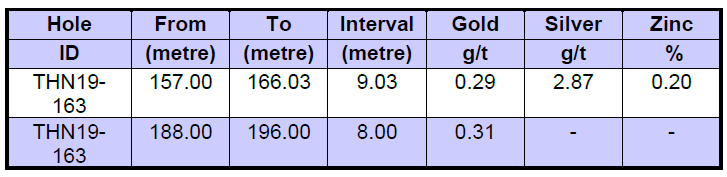

Drill hole 163 was designed to test a high chargeability anomaly delineated by the fall 2019 TITAN 24 DCIP Survey conducted in the Camp Creek area. The hole intersected gold-silver-zinc mineralization, which is hosted mainly in a matrix rich diatreme breccia unit and consists of sulphides as disseminated or veins. Highlights of the analytical results from hole 163 are shown in table below.

Table 3. Composite Assays for THN19-163

All reported assays are uncut weighted averages and represent drilled core lengths. The true width of reported mineralization is unknown at this time.

Table 4: THN19-161 – 163 Collar Information

Chivas Zone Drilling Summary

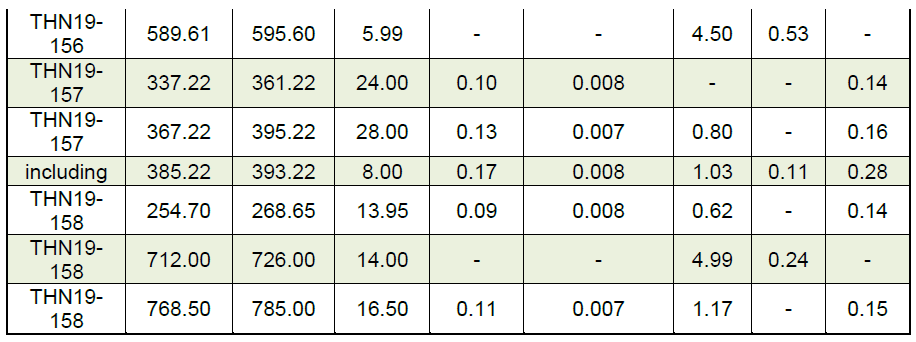

The 2019 drilling at the Chivas Zone consisted of a total of 4,018m within six holes over an area of approximately nine hectares. The depths of the holes varied from 544m to 862m. The objective of the drilling was to drill test for porphyry related mineralization, which was encountered in previous drilling in hole 149 (see News Release dated September 7, 2017) and corroborated with multi-kilometre surface geochemistry anomaly and geological field mapping. The drilling campaign successfully intersected porphyry related copper-molybdenum-silver-(±gold) mineralization. Mineralization is associated with chalcopyrite, pyrite and molybdenite and occurs as disseminated or porphyry style veins. A table of highlights of the analytical results is shown below (Table 5).

Figure 8. Chivas Zone Drill Location Plan Map

VP of Exploration for Brixton Metals, Mr. Sorin Posescu stated, “While the Chivas Zone is a legitimate porphyry discovery that exhibits a very large surface Cu-Au-Mo geochemical footprint, this year’s drilling results have returned lower grades than anticipated. As a result, we are planning to further digest and interpret the 2019 Chivas analytical data over the winter months. We will also be assessing other areas on the property that present high potential for a porphyry discovery.”

Table 5. Composite Assays for the Chivas Zone drill holes

All reported assays are uncut weighted averages and represent drilled core lengths. The true width of reported mineralization is unknown at this time. Copper Equivalent values (CuEq) were calculated using formula CuEq = ($1250 x Au g/t ÷ 31.10+ $15.40 x Ag g/t ÷ 31.10 + $2.80 x % Cu ÷ 100 x 2204.63 + $11.79 x % Mo ÷ 100 x 2204.63) ÷ ($2.80 ÷ 2204.62 x 100)

Table 6: Chivas Drill Holes Collar Information

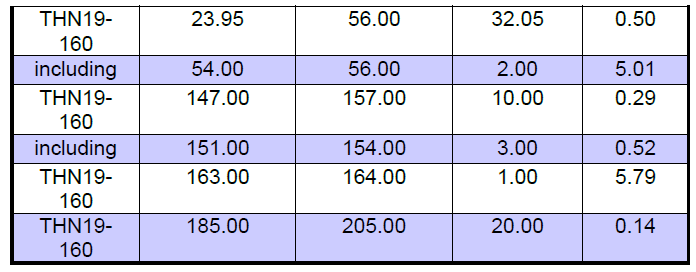

Outlaw Zone Drilling Summary

As previously disclosed by the Company in the News Release dated November 14, 2019, the Company drilled two holes at the Outlaw Zone for a total of 689m in holes THN19-159 and THN19-160. The Company conducted screen metallic assays on select samples from hole 159 which returned higher gold grades (see Table 8 below). The analytical results from hole 160 reported below confirms the robustness of the gold system at the Outlaw zone where drilling continues to deliver gold mineralization over significant widths and remains open in several directions.

Table 7. Composite Assays for THN19-160

All reported assays are uncut weighted averages and represent drilled core lengths. The true width of reported mineralization is unknown at this time.

Table 8. Composite Screen Metallics vs Original Assays for THN19-159

All reported assays are uncut weighted averages and represent drilled core lengths. The true width of reported mineralization is unknown at this time.

Table 9: THN19-160 Collar Information

The Outlaw Zone represents a multi-kilometre long intrusion-related sediment-hosted gold-silver target. Mineralization is hosted within multiple horizons of sub-horizontal sediments (or siliclastics) as interbedded siltstone-graywacke with both stratigraphic and structural controls. Mineralization is also hosted in granodiorite and rhyodacite units. Early exploration work on the Outlaw Zone conducted by Chevron’s Mineral Division in the 1980’s entailed soil and rock geochemical surveys, trenching and a series of drill holes. Follow-up geological mapping and further geochemical work was conducted by Rimfire Minerals from 2000-2004. Brixton conducted further detailed soil-rock geochemical surveys and drilled a series of core holes at broad centres for about 450m of continuous strike on the west side of the gold-in-soil anomaly. Previous drilling by Brixton at the Outlaw Zone intersected 59.65m of 1.15 g/t Au, 5.64 g/t Ag from 76m depth in drill hole THN14-128 and 52.00m of 0.94 g/t Au, 5.95 g/t Ag from 78m depth and a second interval of 18m of 1.61 g/t Au, 12.31 g/t Ag from surface in drill hole THN16-132. During 2018, Brixton collected rock grab samples from the west end of the Outlaw gold-in-soil anomaly returning up to 39.4 g/t Au.

Figure 9. Outlaw Geology and Drill Location Map

Figure 10. Outlaw Gold Geochem and Drilling Map

Property Wide New Porphyry Targets Update

As previously disclosed in News Release dated October 30, 2019, Brixton staked an additional 977 square kilometres of mineral claims in 2019. The new claims were acquired based on the British Columbia Geological Survey re-analysis of stream sediment data which highlights high porphyry Copper potential (Geoscience BC Report 2018-14, 18 May 2018). To date the Company has focused its exploration efforts on approximately 5,000 hectares which represents only 2.5 percent of the total mineral claims.

As part of the data compilation for the region, the Company had identified 46 minfile occurrences that include gold-silver and bornite-chalcopyrite showings located on its mineral claims that have yet to be followed up.

Figures 11. Multiple Regression for High Porphyry Copper Potential and Minfile Occurrences

Quality Assurance & Quality Control

Ms. Caroline Vallat, P.Geo., from GeoSpark Consulting Inc. conducted an independent QAQC review, which returned overall strong accuracy and precision of the analytical results. Sealed samples were shipped by the Company geologists to ALS Minerals preparation lab in Whitehorse, Yukon. ALS Minerals Laboratories is registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Blank, duplicate and certified reference materials were inserted into the sample stream. Analysis for gold was done by Fire Assay with AA finish. All other elements were analyzed by Four Acid Digestion with ICP-MS finish. Silver and base metal over-limits were analyzed by Ore Grade Four Acid Digestion with ICP-AES finish. A copy of the QAQC protocols can be viewed at the Company’s website.

Due to rounding, numbers presented throughout this news release may not add up precisely to the totals provided.

Corporate Update

Brixton has entered into a purchase agreement with Surge Exploration Inc. to acquire mineral claims representing 32,616.87 hectares in size contiguous to the Thorn Project. The claims will be acquired solely for consideration of 350,000 common shares of the Company, subject to TSX Venture Exchange acceptance. The acquisition shares will have a 4 month hold period.

Figure 12. New Mineral Claims Acquired by Brixton

Mr. Sorin Posescu, P.Geo, Vice President Exploration for Brixton Metals and a Qualified Person as defined under National Instrument 43-101 standards has reviewed and approved the technical information in this news release.

About the Thorn Project

The wholly owned Thorn Project is a 2,299 square kilometre claim group located in northwestern British Columbia, Canada, approximately 90 km ENE from Juneau, AK with the southern claim boundary located near the Alaskan border and tide water. The project is within the traditional territory of the Taku River Tlingit First Nation where in 2013 an Exploration Agreement was signed. The Company has also engaged with the Tahltan First Nations Central Government.

The Thorn Project hosts a district scale Triassic to Eocene volcano-plutonic complex with many styles of mineralization related to porphyry and epithermal environments including a large-scale intrusive-related sediment-hosted gold-silver target. Further information regarding the Thorn Project, including resource estimates, can be found in the Company’s technical report prepared by SRK Consulting dated December 12, 2014 and filed on SEDAR. The original discovery at the Thorn Project dates back to 1959 by the Kennco team.

About Brixton Metals Corporation

Brixton is a Canadian exploration and development company focused on the advancement of its gold and silver projects toward feasibility. Brixton wholly owns four exploration projects, the Thorn copper-gold-silver and the Atlin Goldfields projects located in NWBC, the Langis-Hudson Bay silver-cobalt project in Ontario and the Hog Heaven silver-gold-copper project in NW Montana, USA. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB. For more information about Brixton please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

Tel: 604-630-9707 or email: info@brixtonmetals.com

For Investor Relations please contact Mitchell Smith

Tel: 604-630-9707 or email: mitchell.smith@brixtonmetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds, By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.